The utility process for installment loans with fast funding has been streamlined to accommodate the needs of recent debtors.

The utility process for installment loans with fast funding has been streamlined to accommodate the needs of recent debtors. Most lenders provide an internet application course of, eliminating the necessity for prolonged paperwork and in-person visits. Applicants usually need to offer private data corresponding to earnings, employment standing, and details about their financial background. Once submitted, lenders review applications rapidly, usually offering selections within minutes. Upon approval, funds can be deposited immediately into the borrower's bank account,

Casino Game typically as soon as the same day. It's essential for debtors to check various lenders, looking for favorable phrases and situations to keep away from hidden fees and high-interest rates.

In right now's unpredictable monetary local weather, many people and households face unexpected bills that can shortly lead to monetary distress. Whether it’s urgent medical bills, unexpected automobile repairs, or sudden job loss, getting access to monetary assets in such situations is crucial. This is where emergency expenses loans come into play. These loans are designed specifically for individuals who want quick financial assistance to cowl emergencies. However, the landscape of emergency bills loans is huge, providing various choices that cater to different wants and situations. In the next sections, we will delve deep into what emergency expenses loans are, how they work, the kinds out there, their professionals and cons, and supply actionable ideas for choosing the right loan in your emergency wants.

Online loans for medical bills refer to monetary products that people can apply for online to cover their medical bills. These loans often come with terms that cater specifically to medical needs, often permitting for smaller amounts to be borrowed with versatile reimbursement options. Unlike conventional financial institution loans, the application process is often faster and more easy, enabling borrowers to entry funds swiftly after they need them probably the most. Online platforms also present a spread of choices, from private loans to payday loans, particularly designed for urgent medical situations.

In recent years, payday loans have garnered important consideration, particularly amongst individuals who want quick money for surprising expenses. For new borrowers, navigating the world of payday loans can be both exciting and daunting. The fast turnaround time and easy application process make these loans attractive; nonetheless, understanding the risks and implications is crucial for making informed monetary decisions. Why are payday loans for brand new debtors significant? They provide immediate aid in emergencies but come with high-interest rates and potential pitfalls. In this article, we'll explore what payday loans are, how they work, the risks involved, and suggestions for new debtors to handle these loans successfully. Armed with this data, new debtors could make better decisions and avoid falling into the cycle of debt that always accompanies payday lending.

New debtors also needs to think about alternatives to payday loans that may alleviate financial pressure. For occasion, a personal mortgage from a financial institution or credit union sometimes provides lower interest rates and extra favorable reimbursement terms. Borrowers also can explore options like installment loans, which allow for more manageable funds over time. Additionally, utilizing a bank card for emergencies or in search of help from local charities and non-profit organizations can provide financial aid without the burdensome costs related to payday lending.

Having a monetary security net is crucial. Emergency expenses loans act as instant access to money, guaranteeing that people can cowl unforeseen bills without derailing their budgets. A research carried out by the Federal Reserve indicates that just about 40% of Americans would struggle to cover an sudden $400 expense with out borrowing or promoting one thing. This statistic underscores the importance of these loans in today’s economic system. They are not only for those with decrease incomes; even higher-earning individuals find themselves in need of economic assist when confronted with sudden expenses.

As interesting as payday loans online could seem, they do not seem to be the only option available for these in need of quick money. Several options could be explored relying on your monetary scenario and needs. Personal loans from credit unions or banks often carry lower interest rates and longer reimbursement phrases compared to payday loans.

Consider the story of a family faced with a sudden medical expense of $3,000. Unable to cowl the price instantly from their savings, they turned to a private mortgage. The mortgage had a good rate of interest in comparability with the standard payday loan. With careful planning, they were able to manage the repayments within a yr and prevented adding to their monetary stress. Another example entails a person whose automobile broke down unexpectedly. Faced with a $1,500 restore bill, he opted for a bank card with low-interest promotional financing. By strategically managing the funds, he improved his credit rating whereas masking the essential bills.

O que é a Análise Corporal e Traços de Caráter? O método mais rápido do mundo para entender sua mente!

O que é a Análise Corporal e Traços de Caráter? O método mais rápido do mundo para entender sua mente!

Understanding Slot Volatility Levels at 1Win Canada

Understanding Slot Volatility Levels at 1Win Canada

Latisse im Test: Wirksamkeit und Erfahrungsberichte

Po Peter Schulz

Latisse im Test: Wirksamkeit und Erfahrungsberichte

Po Peter Schulz Infinity Casino: Your Ultimate Guide to Online Gaming Excellence

Po Estra

Infinity Casino: Your Ultimate Guide to Online Gaming Excellence

Po Estra Earn Money From Your Unused Networks

Po manfredmann

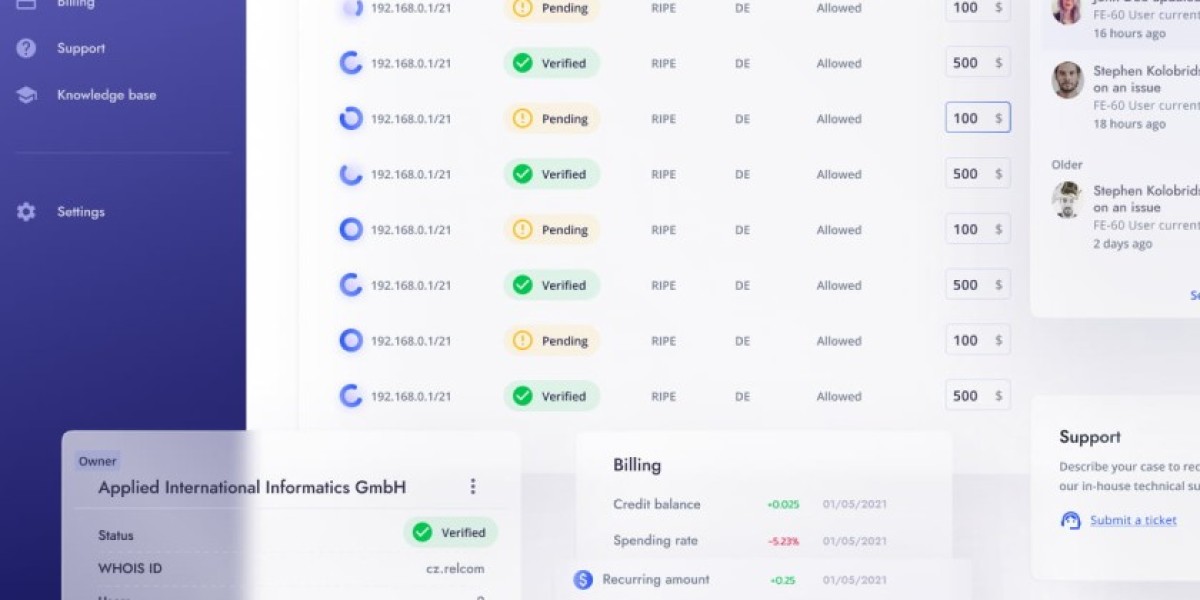

Earn Money From Your Unused Networks

Po manfredmann