In recent years, the financial technology sector has witnessed a remarkable transformation, primarily driven by the emergence of decentralized finance (DeFi). This innovative approach to financial services is reshaping traditional banking and investment paradigms. As we delve into the latest fintech trends, it becomes evident that DeFi is not just a passing phase but a fundamental shift in how we perceive and interact with financial systems.

Understanding Decentralized Finance

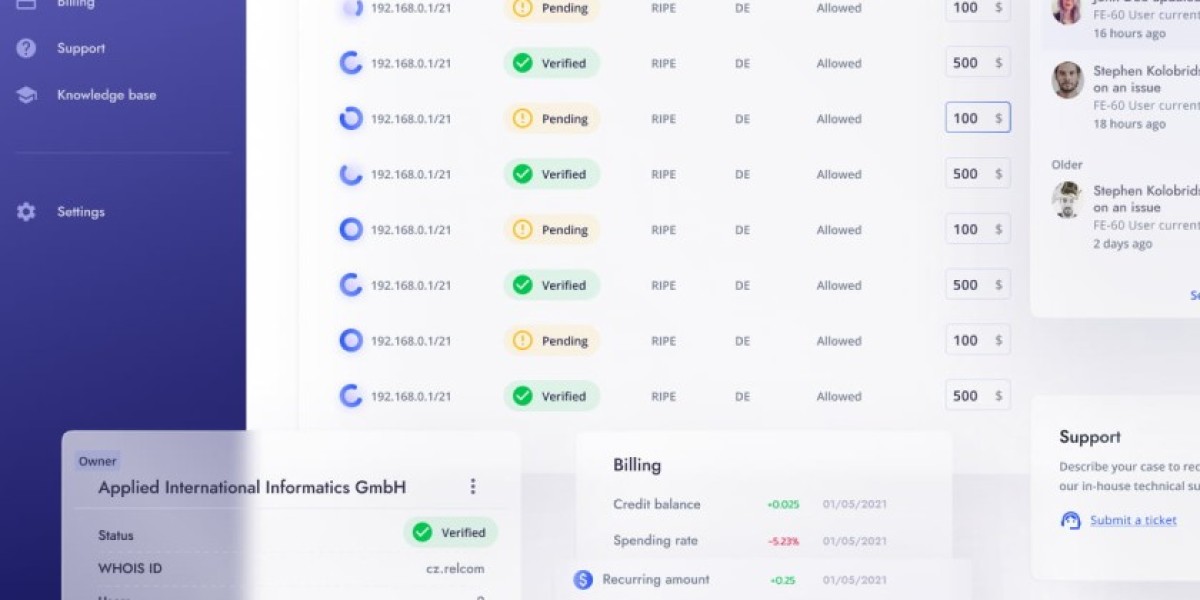

Decentralized finance refers to a system of financial applications built on blockchain technology, allowing users to engage in financial transactions without intermediaries. But what does this mean for the average consumer? Essentially, it empowers individuals by providing greater control over their assets and reducing reliance on traditional banks. This shift raises several questions: How will this impact the accessibility of financial services? Will it lead to a more inclusive financial ecosystem?

Key Fintech Trends Shaping DeFi

- Smart Contracts: These self-executing contracts with the terms of the agreement directly written into code are revolutionizing transaction processes.

- Tokenization: The ability to convert physical assets into digital tokens is enhancing liquidity and accessibility in various markets.

- Yield Farming: This practice allows users to earn rewards on their cryptocurrency holdings, creating new investment opportunities.

- Decentralized Exchanges (DEXs): These platforms enable peer-to-peer trading of cryptocurrencies, eliminating the need for centralized authorities.

The Impact of DeFi on Traditional Financial Services

As fintech trends continue to evolve, the implications for traditional financial institutions are profound. Banks and financial service providers must adapt to remain competitive. If they fail to embrace these changes, they risk becoming obsolete. For instance, the rise of DEXs challenges the very foundation of how trading occurs, prompting banks to rethink their strategies. Moreover, the transparency and security offered by blockchain technology can enhance trust in financial transactions.

Challenges and Considerations

Despite the promising outlook of decentralized finance, several challenges remain. Regulatory uncertainty poses a significant barrier to widespread adoption. How can regulators ensure consumer protection while fostering innovation? Additionally, the volatility of cryptocurrencies can deter potential users. It is crucial for stakeholders to address these concerns to facilitate a smoother transition into the DeFi landscape.

In conclusion, the rise of decentralized finance is a pivotal moment in the evolution of fintech trends. As we move forward, it is essential for consumers, investors, and institutions to stay informed and adapt to these changes. By understanding the implications of DeFi, we can better navigate the future of financial services. For those interested in exploring more about the intersection of technology and finance, consider visiting .